[ad_1]

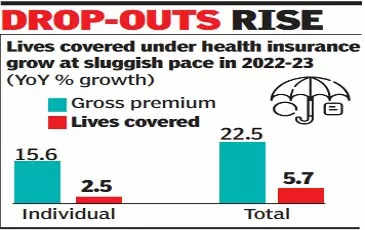

MUMBAI: Medical insurance penetration in India has been rising at a slow tempo in spite of the top expansion of twenty-two% in top rate numbers. The collection of lives coated beneath particular person insurance policies in March 2023 grew 2.5% to 528.9 lakh — not up to March 2021 ranges.

Total, the collection of lives coated beneath medical insurance, together with the gang industry, has larger 5.7% in FY23 from FY24.

Then again, the well being top rate accumulated by way of the insurance coverage business has larger 22% to Rs 89,492 crore from Rs 73,052 crore in March 2022. The pointy upward push in medical insurance premiums and not using a corresponding build up within the collection of lives coated signifies that insurers are rising their industry by way of gathering extra premiums from the similar policyholders.

Earlier than the onset of the pandemic, in March 2020, the entire collection of lives coated beneath particular person medical insurance insurance policies was once 432 lakh. After, alternatively, the quantity jumped 22% to 531 lakh in March 2021. Because the pandemic waned, quite a lot of folks dropped out, and the lives coated beneath particular person insurance policies fell to 516 lakh in FY22.

Executive scheme enrolment has additionally dropped, in part on account of states opting for to do their very own insurance coverage. From 36.2 crore in FY20, executive scheme protection fell to 34.3 crore in FY21 and declined to 30.6 crore in FY22. In FY23, the entire quantity coated beneath executive schemes was once 29.8 crore.

Consistent with brokers, the price of medical insurance affordability has been a subject matter and plenty of older folks, who’re taking part in just right well being, are falling by the wayside on account of upper charges. One sure pattern is that the claims-to-premium ratio has considerably larger from the pandemic ranges. In FY23, normal and well being insurers settled 2.4 crore medical insurance claims and paid Rs 70,930 crore against the agreement of those claims.

[ad_2]

Source link