[ad_1]

New Delhi: The insurance coverage regulator is eyeing enhanced scrutiny of advanced insurance coverage merchandise, particularly the ones aimed toward people over 55, together with well being and financial savings plans to curb misselling.

The Insurance coverage Regulatory and Construction Authority of India, IRDAI, is in discussions with all stakeholders, together with banks, about making sure transparency in gross sales and introducing obligatory video verification prior to coverage acceptance, stated folks acutely aware of the topic.

“There’s a view that scrutiny for advanced merchandise must be tightened additional. This will have to be extra so in circumstances the place the advantages range because of market-linked merchandise and well being or financial savings merchandise presented to the age staff above 55,” the individual stated, including {that a} case could also be made for better transparency whilst promoting such merchandise, particularly to illiterate consumers.

The regulator could also be in dialogue for extra responsibility by way of all events, which contains an acceptable framework to behavior an audit of the solicitation procedure, buyer results, and redressal mechanisms.

“IRDAI is taking a look to curb misselling in the course of the bancassurance channel, and it’s been prompt that bancassurance companions is not going to assign any goals and provides direct or oblique incentives to their workforce for promoting insurance policies,” stated a financial institution government, including that the proposal additionally includes audits at common periods.

An e-mail despatched to IRDAI didn’t obtain any reaction until press time.

Bancassurance is a partnership between banks and insurance coverage corporations to promote insurance coverage merchandise via financial institution branches.

Amongst different measures, IRDAI has additionally prompt that bancassurance companions use overview standards evolved by way of insurers and templates as a part of coverage paperwork, the authentic quoted previous added.

In December 2023, monetary products and services secretary Vivek Joshi held a gathering with chiefs of state-run banks over problems associated with bancassurance, together with its effectiveness in expanding insurance coverage penetration and demanding situations within the type of misselling.

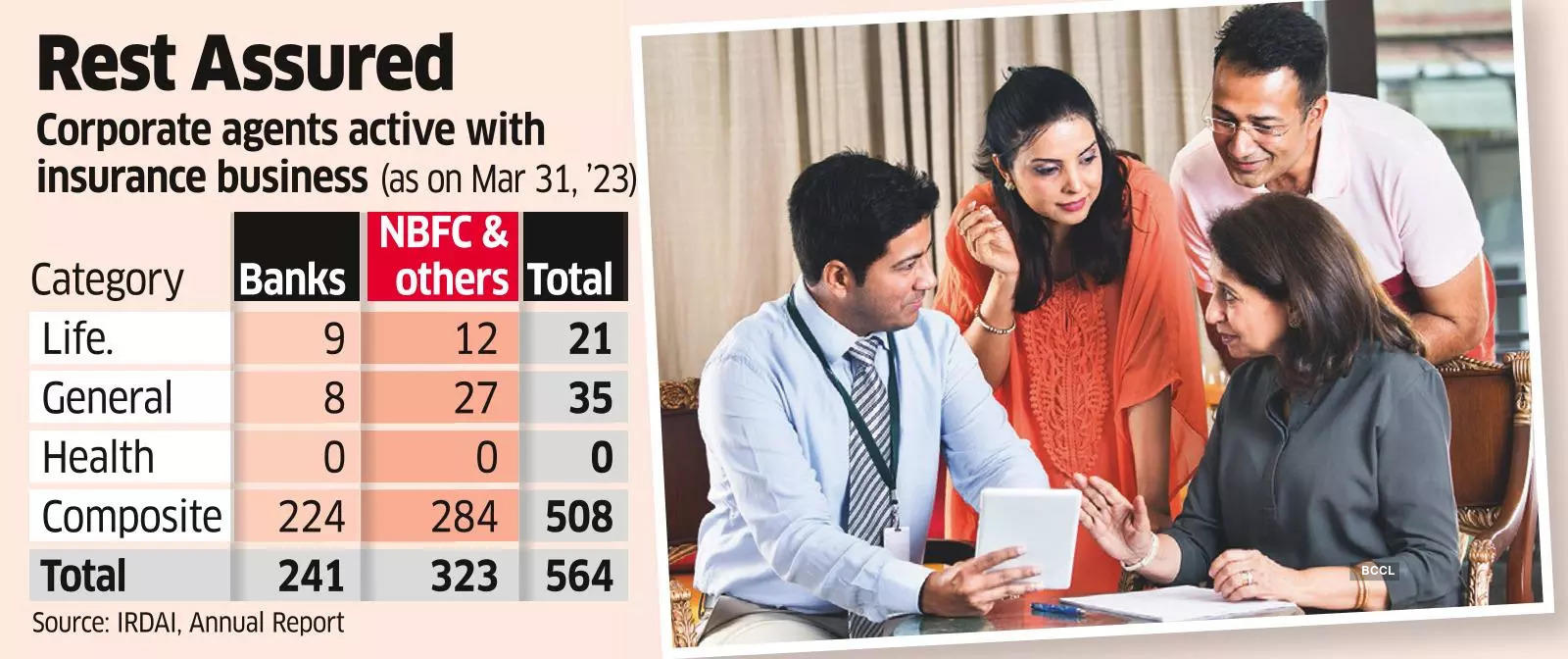

In 2022-23, the contribution of banks as company brokers used to be 5.93% in non-life premiums and 17.44% in new industry premiums for existence insurance coverage.

Remaining week, ET reported that the Source of revenue-Tax Division is learnt to have ready an overview document on how a string of intermediaries have been utilized by insurers to repay additional commissions-over and above allowed underneath regulations-to their brokers promoting insurance coverage insurance policies.

[ad_2]

Source link